Buffett announces his successor: Who is Greg Abel?

He has been determined who will replace Warren Buffett as CEO of the $862 billion Berkshire empire: Greg Abel. So, will the 61-year-old manager be able to fill the legend's shoes? In June 2022, he sold his 1% stake in Berkshire Hathaway Energy for $870 million.

When Greg Abel was an ambitious executive in the energy industry in the 1990s, he was Warren Buffett's neighbor in Omaha, Nebraska, where Berkshire Hathaway was located.

The two did not know each other back then, but 30 years have passed and Abel, a Canadian famous for his straightforward attitude, is now preparing to replace Buffett at the top of Berkshire.

Because Buffett remained at the helm of the company for so long, other successor candidates either died or stepped aside.

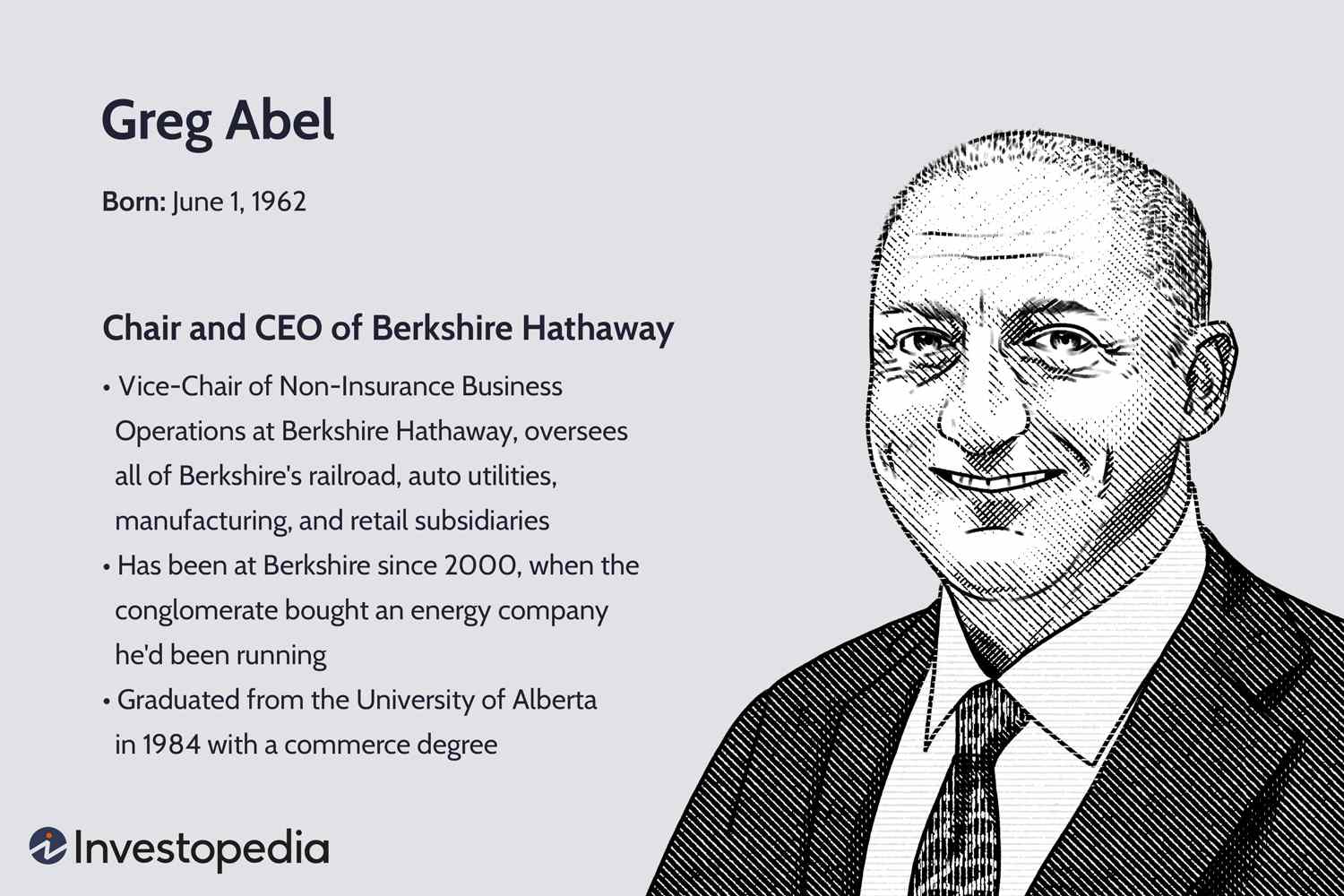

Gregory Edward Abel (born June 1, 1962) is a Canadian businessman, chairman and CEO of Berkshire Hathaway Energy, and vice-chairman of non-insurance operations of Berkshire Hathaway since January 2018. In June 2022, he sold his 1% stake in Berkshire Hathaway Energy for $870 million.

Abel, who joined Berkshire in 2000, was announced as a candidate for CEO by Buffett's late partner Charlie Munger at the shareholders meeting in 2021. Now their skills will be tested in many areas.

Abel, 61, must show that he can allocate $10 billion in flows from Berkshire's operating activities to Omaha each quarter. It will become increasingly difficult to find large-scale and accurate new acquisitions that will make a difference in the $862 billion company.

Meanwhile, the board of directors includes Buffett's children, Howard and Susie, as well as executives such as Ajit Jain, who is the head of Berkshire's insurance business and has been working directly under Buffett for years. Described by his colleagues as balanced and solution-oriented, Abel has taken on significant responsibilities at Berkshire since his promotion to the board of directors in 2018. He is responsible for companies such as Precision Castparts aviation group, which includes Boeing among its customers, and Clayton Homes, America's largest modular housing company.

Buffett's choice of Abel was influenced by improvements in the companies' business performance and his ability to find the right deals. A native of Edmonton and a graduate of the University of Alberta, Abel has three decades of experience in the energy and grid industry.

After working at PwC, one of the Big Four (i.e. Deloitte, Ernst & Young, KPMG, and PwC), he moved to the small geothermal energy group CalEnergy, one of the company's clients. There, together with then-CEO David Sokol, they made an acquisition move and acquired MidAmerican. The Iowa-based firm would later be acquired by Berkshire in 2000.

This agreement brought the duo to Berkshire. In 2008, Abel became CEO of MidAmerican. In an interview with the Financial Times in 2021, Sokol said of his friend, “Greg was better than me” in running the business.

Sokol was once considered a successor to Buffett, but he resigned in 2011 following an investigation into his stock trading in the chemical company Lubrizol.

As Buffett, 93, gradually retired from Berkshire's day-to-day operations, Abel took over the role of chief problem solver.

A board member who spoke to the Financial Times said the company's culture was ingrained in Abel, who worked very closely with Buffett and Munger for years.